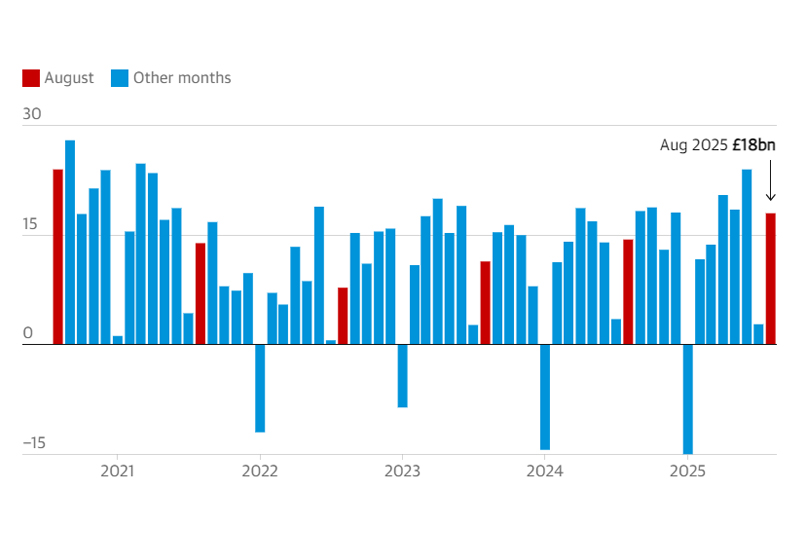

UK borrowing last month was the highest in any August for five years

Home Archive by category "News"

UK government borrowing rose to a five-year high in August, official figures show, fuelling growing expectations for Rachel Reeves to raise taxes at the autumn budget and knocking the pound.

Figures from the Office for National Statistics (ONS) showed public sector net borrowing – the difference between public spending and income – rose to £18bn in August, £3.5bn more than in the same month a year earlier.

Dealing a blow for the chancellor as she prepares for the 26 November budget, the reading was above City predictions for a deficit of £12.75bn and forecasts from the Office for Budget Responsibility (OBR) of £12.5bn.

On top of upward revisions to previous months, total borrowing for the financial year to date jumped to £83.8bn, also the highest level since the height of the Covid pandemic in 2020. The total was £16bn higher than in 2024 and above a £72.4bn forecast from the OBR.