Why Sticking to a Trading Plan Can Save You Thousands

Introduction: Forex in a Fast-Changing World

In 2025, global financial markets are facing historic shifts—rising inflation, geopolitical tensions, evolving trade agreements, and unpredictable interest rate policies. In the middle of all this change, one market remains resilient, flexible, and full of opportunity: the foreign exchange market, or Forex.

Now averaging over $7.5 trillion in daily trading volume, Forex has become more than just a currency exchange mechanism—it’s a strategic trading landscape for both individual and institutional investors worldwide.

What Makes Forex So Relevant Today?

- Global Economic Uncertainty = More Volatility

Volatility drives opportunity—and Forex thrives on volatility. Central banks are raising and lowering interest rates to fight inflation, and every press release from the Federal Reserve or ECB sends currency pairs into motion. For active traders, this creates numerous short- and medium-term profit opportunities.

JKV Global Insight: Major pairs like EUR/USD, GBP/JPY, and USD/CHF have seen consistent high-volume moves after rate statements in 2025.

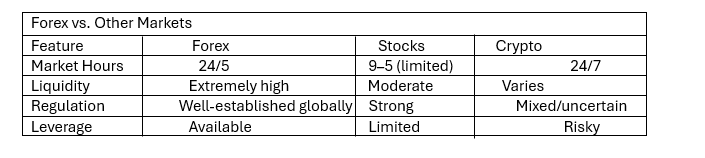

- 24-Hour Market = Non-Stop Access

Unlike stock markets, which operate on limited hours, Forex is open 24 hours a day, five days a week. That means traders can react to global events in real time—from Asia to Europe to North America.

Whether you’re trading before work or analyzing late-night moves, Forex fits your schedule—not the other way around.

- Leverage and Lower Capital Requirements

Forex allows traders to start with smaller capital compared to other markets, thanks to leverage. While leverage should be used wisely, it opens up access for more retail traders who want exposure without high entry costs.

JKV Global offers tailored guidance on responsible leverage usage and risk management tools.

- AI and Automation Are Enhancing Performance

AI-driven analytics, automated trading bots, and smart algorithms are giving traders more data and execution power than ever. In 2025, more than 65% of retail traders use some form of automation or AI-based strategy.

At JKV Global, we offer AI-enhanced Forex tools to help you identify trends faster, reduce emotional decision-making, and improve execution speed.

- Wider Access to Education and Tools

Forex is no longer limited to large institutions. Thanks to better trading platforms, free educational content, and mobile apps, millions of new traders have entered the market globally.

JKV Global supports this new wave with:

Weekly live market briefings

Strategy guides for all experience levels

Customized mentoring programs

As you can see, Forex offers the ideal combination of accessibility, liquidity, and flexibility.

Conclusion: Now Is the Time to Trade Forex

As the global economy continues to shift and evolve, Forex remains the one market that consistently adapts, responds, and delivers opportunities.

Whether you’re a beginner learning the basics or a seasoned trader looking to optimize your strategy with AI tools, Forex trading is more relevant than ever—and JKV Global is here to help you make the most of it.