Top 10 Forex Trading Terms Every Trader Should Know

The forex market is the world’s largest and most liquid financial market, with over $7 trillion traded daily. Whether you’re a beginner or refining your trading strategy, understanding key forex trading terms is essential to navigate the market effectively.

At JKV Global, we believe that strong knowledge is the foundation of trading success. That’s why we’ve compiled this guide to the top 10 forex trading terms every trader should know.

- Pip (Point in Percentage) A pip is the smallest price movement in the forex market, typically equal to 0.0001 for most currency pairs. For example, if EUR/USD moves from 1.1050 to 1.1051, that’s a one-pip move. Understanding pip values helps in calculating profits and losses.

- Spread The spread is the difference between the bid (buy) and ask (sell) price of a currency pair. This is essentially the cost of entering a trade and can vary based on market conditions or your broker’s model.

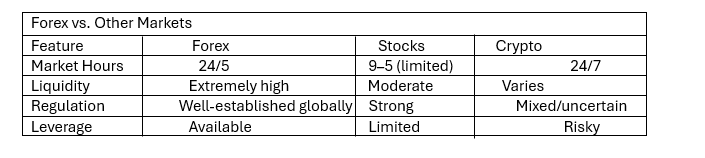

- Leverage Leverage allows traders to control a large position with a relatively small amount of capital. For example, 1:100 leverage means you can control $100,000 with just $1,000. While leverage can amplify gains, it also increases risk.

- Lot Size A lot refers to the volume of a trade. A standard lot is 100,000 units of a currency, while mini (10,000) and micro (1,000) lots are used by smaller traders. Choosing the right lot size is crucial for managing risk.

- Margin Margin is the capital required to open a leveraged position. It acts as a security deposit. Understanding margin requirements helps you avoid margin calls and over-leveraging your account.

- Currency Pair Forex is traded in currency pairs like EUR/USD or GBP/JPY. The first currency is the base currency, and the second is the quote currency. The price indicates how much of the quote currency you need to buy one unit of the base currency.

- Long and Short Positions Going long means buying a currency pair (expecting it to rise), while going short means selling it (expecting it to fall). Forex allows you to profit in both rising and falling markets.

- Stop Loss (SL) A stop loss is a risk management tool that automatically closes your trade at a pre-set level to limit losses. Smart traders always use SLs to protect their capital from unexpected market moves.

- Take Profit (TP) A take profit is a pre-set level where your trade will close automatically to lock in profits. It ensures you exit trades with gains before the market reverses.

- Volatility Volatility refers to how much a currency pair’s price moves over time. High volatility means larger price swings, which can offer more opportunities—but also more risk. Monitoring market news and economic data helps in predicting volatility.

Final Thoughts

Mastering these forex trading terms is a great step toward becoming a more confident and strategic trader. At JKV Global, we’re committed to equipping traders with the tools and knowledge they need to succeed in today’s dynamic forex markets.